Vibecode like a Quantwithout the hassle of writing code

The Agentic Swarm that builds institutional-grade,

code-based strategies for you

SERVING EVERY DEFI

USE CASE

Maximize Yield

Leverage autonomous agents to optimize yields across multiple chains and protocols effortlessly.

Optimize Asset Management

Utilize agent-based automation for dynamic portfolio optimization, adapting seamlessly to market shifts.

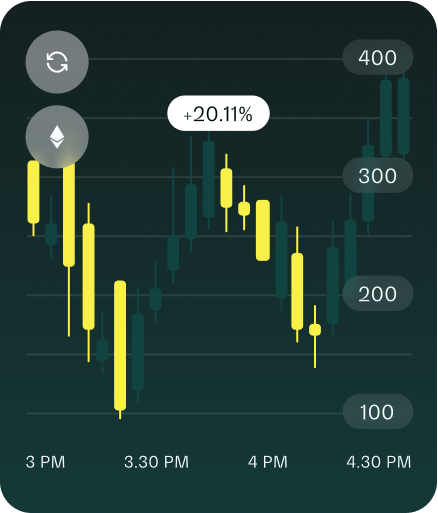

Trade Autonomously

Design and deploy trading strategies powered by autonomous AI agents that never sleep.

Hedge Autonomously

Implement AI-driven risk agents to monitor and proactively manage your portfolio.

UNIVERSAL CHAIN ACCESS

VIA AGENT BASED ACCOUNT ABSTRACTION

Seamlessly interact with all protocols, chains, and trading venues using one, widely integrated LLM interface in a fully

permissionless, non-custodial environment.

SUPPORTING EVERY

STEP

SPECIALIZED AGENTS

FOR EACH TASK

Code & Debug

Describe your strategy. The AI coding agents generate production-grade code - fast, precise, no guesswork.

Backtest

Evaluate your strategy in more 10,000+ Monte Carlo simulation scenarios using the backtesting agent.

Optimize

Let optimization agents fine-tune parameters for maximum capital efficiency and risk-adjusted returns.

Manage Risk

Use AI risk management agents to evaluate and monitor the expected returns of your strategy. Iterate and update the strategy by rebalancing, hedging, and protecting your capital on autopilot.

Deploy

Deploy fully tested, verifiable code in a non-custodial, trustless environment using SAFE-based multisig.

Monitor & Update

Monitor the performance of your agents and strategies in real-time, and receive alerts when they need your attention.

SUPPORTING EVERY STEP

SPECIALIZED AGENTS FOR EACH TASK

Describe your strategy. The AI coding agents generate production-grade code - fast, precise, no guesswork.

Evaluate your strategy in more 10,000+ Monte Carlo simulation scenarios using the backtesting agent.

Let optimization agents fine-tune parameters for maximum capital efficiency and risk-adjusted returns.

Use AI risk management agents to evaluate and monitor the expected returns of your strategy. Iterate and update the strategy by rebalancing, hedging, and protecting your capital on autopilot.

Deploy fully tested, verifiable code in a non-custodial, trustless environment using SAFE-based multisig.

Monitor the performance of your agents and strategies in real-time, and receive alerts when they need your attention.

MAXIMUM PRIVACY

AND CONTROL

PROTECTING CAPITAL

WITH INSTITUTIONAL GRADE SOLUTIONS

NON-CUSTODIAL

Users retain full control over their assets at all times, ensuring no third party ever holds custody during interactions with Almanak's tools.

TRUSTED EXECUTION ENVIRONMENT

A Trusted Execution Environment (TEE) guarantees a secure sandbox within a main processor that ensures sensitive data is stored, processed, and protected in an isolated and tamper-resistant environment.

VERIFIABILITY

Strategy code is fully verifiable, which enables backtesting, optimization and risk assessment prior to deploying the strategy on the market.

OUR INVESTORS

& PARTNERS